In the world of credit cards, finding one that suits your financial situation, especially if you’re looking to rebuild or establish credit, can be daunting. The Milestone Credit Card emerges as an option for those with less-than-perfect credit, offering a pathway to improve creditworthiness without the need for a security deposit. Here’s an in-depth look at what the Milestone Credit Card offers, its benefits, costs, and how to navigate its services.

New and prospective Milestone cardholder typically have a handful of questions about their new card which can include how to apply for the Milestone card, how to activate the Milestone card, how to register and login to your Milestone card account. Below we have included an brief features and benefits section about the Milestone Gold card, an activation guide, login guide, FAQs section, how to navigate the milestonecard.com website and much more. You can visit individual pages for more detailed step-by-step instructions for each of these.

Features of the Milestone Mastercard Credit Card

- Credit Limit: The card starts with a $700 credit limit, which is on the lower side but typical for cards aimed at those with poor or no credit history.

- No Security Deposit: Unlike many credit-building cards, Milestone doesn’t require a security deposit, making it accessible for those who might not have the funds upfront.

- Mastercard Acceptance: As a Mastercard, it’s widely accepted, which means you can use it for online purchases, in-store, and even internationally.

- 24/7 Account Access: You can manage your account online or via mobile, offering convenience in tracking your spending and payments.

- Credit Reporting: Payments and account history are reported to all three major credit bureaus, aiding in credit score improvement.

Benefits of the Milestone Card

Credit Building: For individuals with no credit history or those looking to repair it, the Milestone card provides a straightforward way to build credit by making regular payments.

No Deposit Required: This feature is particularly beneficial for those who can’t afford or prefer not to tie up funds in a security deposit.

Zero Liability for Unauthorized Use: Offering peace of mind with Mastercard’s Zero Liability Protection against unauthorized charges.

Convenience: The ability to make payments or check your balance anytime, anywhere, adds to the card’s usability.

Costs Associated with the Card

Annual Fee: The first year’s annual fee can be as high as $175, reducing your effective credit limit significantly. Subsequent years see a lower fee of $49.

Monthly Fee: There’s also a monthly fee, which could be up to $12.50 after the first year, though this fee might be waived in certain circumstances.

Interest Rates: The APR for purchases is notably high at 35.9%, which could make carrying a balance very costly.

Over limit Fee: If you opt into over limit coverage, you might face an over limit fee.

Who the Milestone Credit Card is Best For?

The Milestone credit card is ideal for those who are looking to build or improve their credit score. If you have a limited credit history, a low credit score, or a history of financial setbacks, this card can help you establish a positive credit history and boost your credit score over time.

While the Milestone credit card may not offer as many perks as some other credit cards, its focus on credit-building features and benefits makes it a reliable choice for those who want to take control of their credit and achieve financial stability.

Applying for a Milestone Credit Card

Applying to be a Milestone card holder is simple. Just visit Milestonegoldcard.com/invite if you already have an invite code or Milestonegoldcard.com/pre-qualify if you don’t have an invite code yet.

Click the Apply Now button or Get Started in the menu and follow the onscreen prompts to apply for the Milestone credit card.

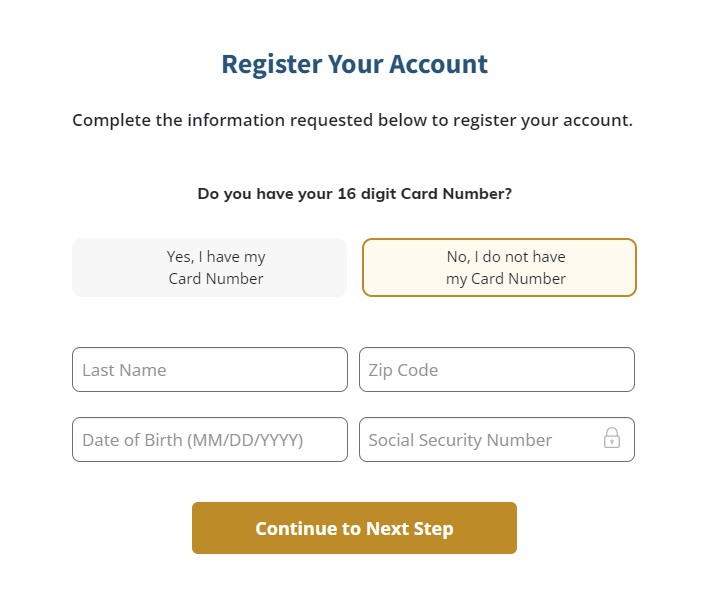

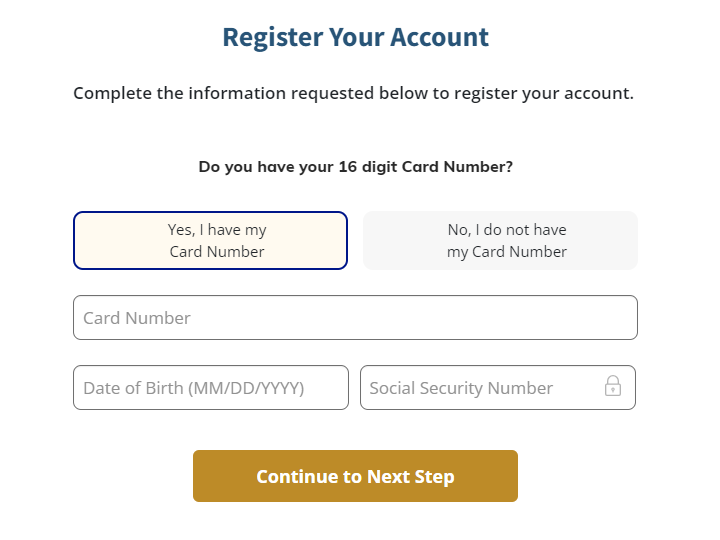

Registering Your Milestone Credit Card

- Visit the Official Website: Go to milestone.myfinanceservice.com or milestonecard.com to start the registration and login process.

- Click on ‘Register’: Look for a section or button labeled ‘Register Your Account’ or similar.

- Enter Your Details: You’ll need to provide the following

- Your Milestone credit card number.

- Personal information like your name, email address, and Social Security number.

- Complete Registration: Follow the prompts to complete the registration. This might also include setting up your username and password for future logins.

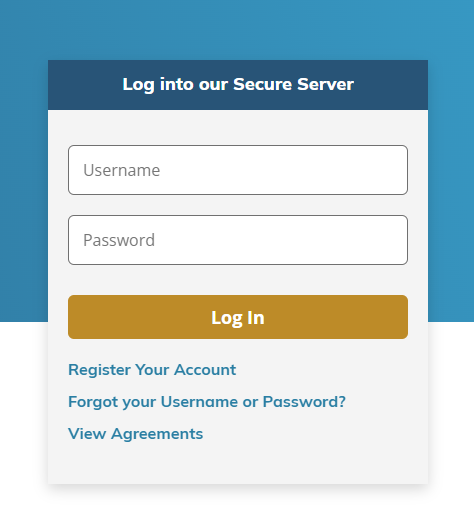

Logging into Your Milestone Credit Card Account

- Visit the Login Page: Go to milestonecard.com or milestone.myfinanceservice.com.

- Enter Login Credentials: Use the username or email and password you set during registration.

- Forgot Credentials? If you forget your username or password, there are recovery options:

- Forgot Username: Enter your email address and Social Security number to retrieve it.

- Forgot Password: Follow the password reset instructions, which typically involve an email verification.

Activating Your Milestone Credit Card

Online Activation

- Go to milestonecard.com/activate and click Register Your Account

- Enter your card details, including the card number, security code, and last four digits of your Social Security number and following the remaining on screen prompts to activate your card.

Activate Card By Phone

- Call the activation number provided on your card or commonly listed as 1-800-305-0330.

- Follow the automated prompts to enter your card details and complete activation.

Important Notes

Security: Always ensure you’re on the official website to avoid phishing scams. Look for ‘https’ in the URL and check for any security badges or locks in your browser’s address bar.

Post-Activation: After activation, you can immediately start using your card for purchases. Remember to set up your account online for easier management of your credit, payments, and to monitor your credit score improvement.

Making Payments on the Milestone Credit Card

Online: Log into your account, navigate to the payment section, and enter your payment amount.

By Phone: Call the customer service number and follow the prompts to make a payment.

Autopay: Set up automatic payments to ensure you never miss a due date.

Simply login to your Milestone account and visit the payments section to make a one-time payment or setup recurring autopay. For more details visit our Milestone Gold credit card payment section.

Contacting Customer Service

To get support for your Milestone credit card you can read our guides or if you want to contact the official Milestone customer service department from Concora Credit, Inc you can contact them through your online account’s help section or get in touch by calling 1-800-305-0330. You can also visit our Milestone customer service page to learn about more options for getting in touch with support.

FAQs About the Milestone Credit Card

What if I miss a payment?

Missing payments can lead to late fees and negatively impact your credit score. Contact customer service to discuss options.

Can I increase my credit limit?

While not guaranteed, making on-time payments might qualify you for a review for a credit limit increase.

Is there a foreign transaction fee? Yes, there’s a 1% fee on transactions outside the U.S.

What happens if I cancel the card?

Canceling might lower your available credit, potentially affecting your credit utilization ratio and score.

How does the card help with credit repair?

By reporting your payment history to credit bureaus, responsible use can improve your credit score.

Conclusion

The Milestone Credit Card, while not without its costs, serves as a viable option for those needing to establish or rebuild credit without a security deposit. Its high fees and interest rates are significant drawbacks, but for those who pay off their balance in full each month and view it as a temporary tool for credit improvement, it could be a stepping stone to better financial products. Always consider your financial situation and compare with other options before deciding if the Milestone card is right for you.